22+ How much lend mortgage

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Fill in the entry fields.

Top 7 Best Real Estate Apis 2022 24 Reviewed

The average APR on a 15-year fixed-rate mortgage rose 7 basis points to 5076 and.

. Ad Award Winning Client Service. Monthly cost of Principal Mortgage Insurance PMI. Insurance and other costs.

Find out how much you could borrow. Common mortgage terms are 30-year or 15-year. 51 Adjustable-Rate Mortgage Rates.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Get Pre-Qualified in Seconds. This mortgage calculator will show how much you can afford.

The 52-week low was 409 compared to a 52-week high of 450. The current average interest rate on a 51 ARM is 450. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

This time last week it was 593. The low end hovers around 35000. Assuming you have a 20 down payment 36000 your total mortgage on a 180000 home would be 144000.

8 hours agoAny person who is of 60 years or more can avail the reverse mortgage scheme. Monthly PMI is calculated by. A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

A mortgage loan term is the maximum length of time you have to repay the loan. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. So if you earn 30000 per year and the lender will lend four times this.

On Saturday September 3rd 2022 the average APR on a 30-year fixed-rate mortgage remained at 5841. Compare Best Mortgage Lenders 2022. APR is the all-in cost of your loan.

Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You. Mortgage lenders generally make good money. Traditionally mortgage lenders applied a multiple of your income to decide how much you could borrow.

In case of a married couple at least one of them should be 60 years of age or more. Compare Offers Apply. For loans secured with less than 20 down PMI is estimated at 05 of your loan balance each year.

A typical mortgage length is 25 years. Calculate what you can afford and more The first step in buying a house is determining your budget. Ad Award Winning Client Service.

DTI Often Determines How Much a Lender Will Lend So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial. Apply Online Get Pre-Approved Today. Find loans for country homes land construction home improvements and more.

Unbeatable Mortgage Rates for 2022. How much would the mortgage payment be on a 180K house. Ad Apply online for a home or land mortgage loan through Rural 1st.

Though some are on a flat salary most make the bulk of their income on commissions. If you lock in. This calculates the monthly payment of a 2 million mortgage based on the.

The APR on a 30-year fixed is 599. Under this particular formula a person that is earning. Longer terms usually have higher rates but lower.

The longer your term the less you may pay each month but youll end up paying more in interest. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan.

Ad Best Home Loan Mortgage Rates. For example if your salary is 54000 per year 4500 per month and your mortgage payment is 1000 then your front-end DTI ratio is 22 1000 4500. Compare Rates Get Your Quote Online.

30 Year 2000000 Mortgage Loan. This calculator computes how much you might qualify for but does not actually qualify you for a. Calculate Your Rate in 2 Mins Online.

Just fill in the interest rate and the payment will be calculated automatically. Compare Rates Get Your Quote Online. How much do I need to make for a 250000 house.

Interest rate The bigger your deposit the better the. For this reason our calculator uses your. At an interest rate of 598 a 30-year fixed mortgage would cost 598.

Were not including any. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

Ex 99 1

Image Result For Candy Poster For Best Friend Birthday Birthday Candy Posters Birthday Gifts For Best Friend Candy Poster

22 Ways To Use A Heloc First Financial Bank

2

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Riven Product Landing Page Template Landing Page App Landing Page Mobile App

2

Halloween Goodie Bags By Rachel The Realtor Halloween Treat Bags Halloween Goodie Bags Client Gifts

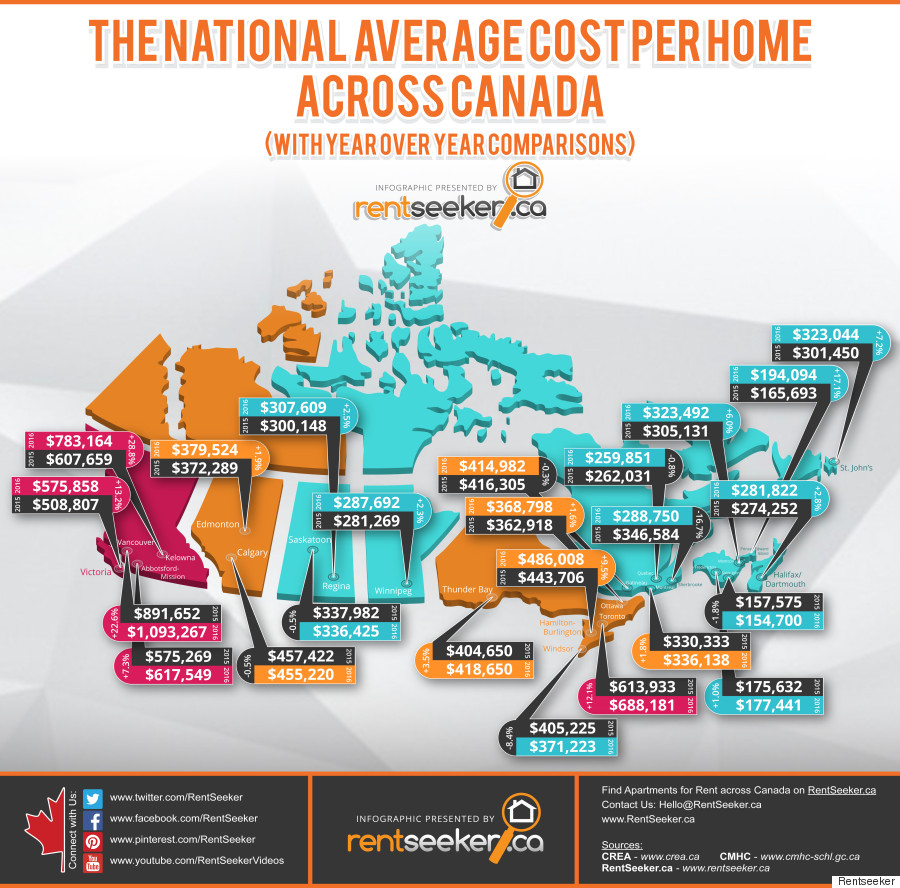

Canada Real Estate Graph

List Of Recruiting And Employment Agencies In Toronto 2020 Talent Portal

280466868 10159610337975923 3299960688973726018 N Jpg

22 Printable Budget Worksheets Printable Budget Worksheet Budgeting Worksheets Free Budgeting Worksheets

2

Distribution Agreement Template 22 Free Word Pdf Documents Download Corporate Credit Card Business Credit Cards Good Essay

State Farm Associates Funds Trust

Ex 99 1

Edition 22 August 2012 By Glasshouse Country Maleny News Issuu